The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Zurn Elkay (NYSE:ZWS) and the rest of the hvac and water systems stocks fared in Q4.

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 9 HVAC and water systems stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10% since the latest earnings results.

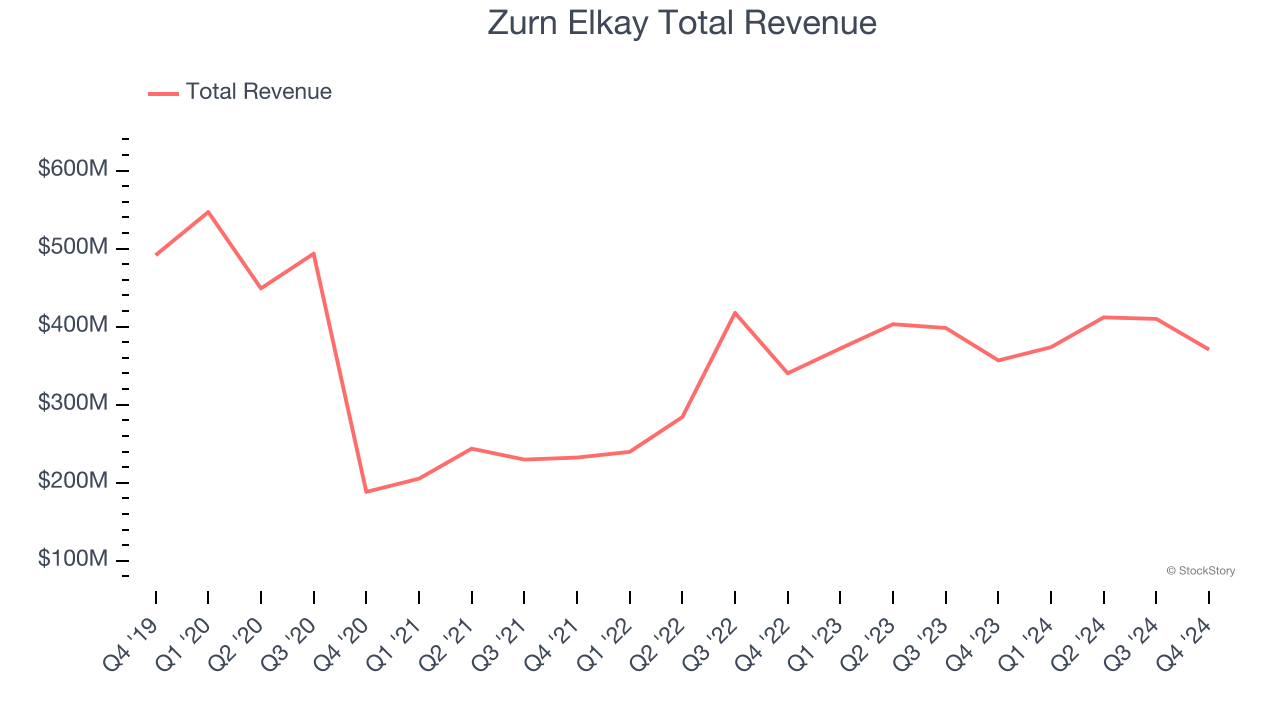

Zurn Elkay (NYSE:ZWS)

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE:ZWS) provides water management solutions to various industries.

Zurn Elkay reported revenues of $370.7 million, up 3.9% year on year. This print exceeded analysts’ expectations by 0.9%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EPS estimates but a significant miss of analysts’ organic revenue estimates.

Todd A. Adams, Chairman and Chief Executive Officer, commented, “2024 was another year of solid execution for us as we delivered record sales, EBITDA and cash flow performance while repurchasing $150 million of our shares and increasing our dividend 12.5% year over year. Despite pockets of challenging end markets, we achieved 4% pro forma core sales(1) growth, improved our adjusted EBITDA(1) margins by 270 basis points and made significant strides in the deployment of our strategies to deliver even better growth in the coming years. Our team's belief in and relentless deployment of the Zurn Elkay Business System positions us to continue to deliver above market growth and continued superior financial performance in 2025.”

The stock is down 14.2% since reporting and currently trades at $33.89.

Is now the time to buy Zurn Elkay? Access our full analysis of the earnings results here, it’s free.

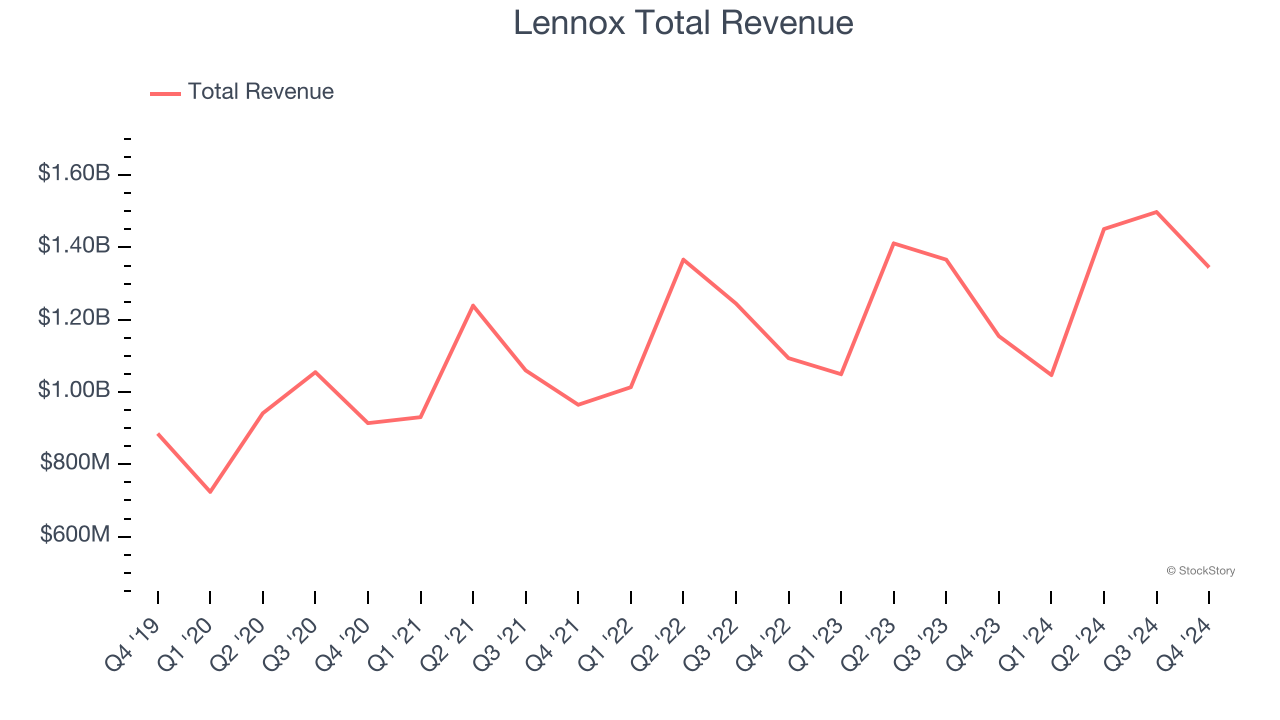

Best Q4: Lennox (NYSE:LII)

Based in Texas and founded over a century ago, Lennox (NYSE:LII) is a climate control solutions company offering heating, ventilation, air conditioning, and refrigeration (HVACR) goods.

Lennox reported revenues of $1.35 billion, up 16.5% year on year, outperforming analysts’ expectations by 8.9%. The business had an exceptional quarter with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EPS estimates.

Lennox pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 13.3% since reporting. It currently trades at $574.61.

Is now the time to buy Lennox? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AAON (NASDAQ:AAON)

Backed by two million square feet of lab testing space, AAON (NASDAQ:AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

AAON reported revenues of $297.7 million, down 2.9% year on year, falling short of analysts’ expectations by 7.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

AAON delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 21.3% since the results and currently trades at $80.29.

Read our full analysis of AAON’s results here.

Carrier Global (NYSE:CARR)

Founded by the inventor of air conditioning, Carrier Global (NYSE:CARR) manufactures heating, ventilation, air conditioning, and refrigeration products.

Carrier Global reported revenues of $5.15 billion, up 19.3% year on year. This result came in 2.2% below analysts' expectations. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but full-year revenue guidance slightly missing analysts’ expectations.

Carrier Global pulled off the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $65.86.

Read our full, actionable report on Carrier Global here, it’s free.

CSW (NASDAQ:CSWI)

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ:CSWI) offers special chemicals, coatings, sealants, and lubricants for various industries.

CSW reported revenues of $193.6 million, up 10.7% year on year. This print surpassed analysts’ expectations by 0.9%. It was a strong quarter as it also put up an impressive beat of analysts’ EPS estimates and EBITDA in line with analysts’ estimates.

The stock is down 14.6% since reporting and currently trades at $294.58.

Read our full, actionable report on CSW here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.