Global X Copper Miners ETF (COPX)

35.52

+2.10 (6.28%)

NYSE · Last Trade: Apr 12th, 12:30 AM EDT

Detailed Quote

| Previous Close | 33.42 |

|---|---|

| Open | 34.41 |

| Day's Range | 34.36 - 35.74 |

| 52 Week Range | 30.77 - 52.90 |

| Volume | 2,095,196 |

| Market Cap | 22.96M |

| Dividend & Yield | 0.3180 (0.90%) |

| 1 Month Average Volume | 1,518,701 |

Chart

News & Press Releases

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Thursday, April 10

Via Talk Markets · April 11, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 10, 2025

Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners. This provided a boost to risk assets, including commodities. However, there’s still plenty of uncertainty as the US again increased tariffs on China.

Via Talk Markets · April 10, 2025

Mining sector hit hard by new tariffs, but analysts expect a V-shaped recovery with potential for significant upside. Top stock and ETF picks.

Via Benzinga · April 9, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 9, 2025

Stocks are in an unambiguous bear trend right now.

Via Talk Markets · April 8, 2025

Via Benzinga · April 8, 2025

Liberation Day isn’t just another headline - it’s a turning point for the global economy.

Via Talk Markets · April 4, 2025

Trump tariff sell-off continues.

Via Talk Markets · April 4, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 3, 2025

Silver is up more than gold – outperforming it on an immediate-term basis. At the same time, miners are down. This is a classic short-term sell signal.

Via Talk Markets · April 2, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 2, 2025

The first quarter was an incredibly tumultuous period for markets, with the S&P 500 posting its biggest quarterly decline since 2022.

Via Talk Markets · April 1, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 1, 2025

While gold captures the spotlight, copper is quietly stealing the show.

Via Talk Markets · March 31, 2025

A significant drop in Asian stock markets led to a decline in copper prices, despite rising long-term demand and tightening supplies.

Via Talk Markets · March 31, 2025

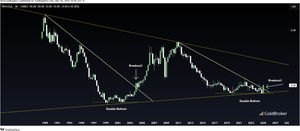

A couple of Copper charts that suggest the commodity boom (think

Via Talk Markets · March 31, 2025

Copper ETFs hit record highs as U.S. considers imposing tariffs on imports. Prices spike, inflows surge and miners benefit. Global supply concerns.

Via Benzinga · March 27, 2025

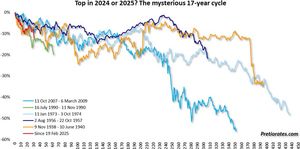

A standard business cycle in the US economy takes around four years to play out, from weakness to strength to weakness.

Via Talk Markets · March 27, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · March 27, 2025

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Wednesday, March 26.

Via Talk Markets · March 27, 2025

The relationship between tariff announcements and copper prices follows a remarkably consistent pattern.

Via Talk Markets · March 26, 2025

Copper’s weekly chart reveals a major resistance zone between $5.00 and $5.20 — a level that has held firm for the past three years.

Via Talk Markets · March 26, 2025

U.S. tariffs on copper imports could be imposed within weeks, not months.

Via Talk Markets · March 26, 2025

Copper prices are on an upward trajectory, entering new and uncharted territory.

Via Talk Markets · March 26, 2025