iShares MSCI Japan Index Fund (EWJ)

74.12

+0.09 (0.12%)

NYSE · Last Trade: May 31st, 6:14 AM EDT

Ishiba's stern stance on the U.S.-Japan trade issue comes amid a further drop in his support ahead of the July Upper House election.

Via Stocktwits · May 19, 2025

After announcing a 24% tariff on Japanese imports in early April as part of President Donald Trump’s Liberation Day levies, the U.S. has paused implementation to allow scope for negotiations.

Via Stocktwits · May 12, 2025

According to a report, citing a finance ministry official, autos, steel, and mineral fuels contributed most to the slowdown in export growth.

Via Stocktwits · May 9, 2025

China’s spokesperson said if the U.S. wants to talk, it has to show sincerity and be prepared to correct its wrong practices and cancel the unilateral tariffs.

Via Stocktwits · May 1, 2025

Katsunobu Kato, a member of parliament, is set to meet U.S. Treasury Secretary Scott Bessent this week in Washington, with the second round of trade talks set to follow later this month.

Via Stocktwits · April 23, 2025

A high-level delegation headed by Tetsuo Saito, chief of the ruling Liberal Democratic Party's junior coalition partner, will deliver a letter to Xi Jinping during a three-day visit, beginning on Tuesday.

Via Stocktwits · April 22, 2025

We're truly dealing with equity market destruction of epic proportions since the President re-took office.

Via Talk Markets · April 21, 2025

Premier Shigeru Ishiba’s remarks came a day after he said on public TV that the ongoing Japan-U.S. trade negotiations should serve as a model for talks between the U.S. and other countries.

Via Stocktwits · April 21, 2025

Donald Trump's sweeping tariff announcement, speculators who wagered on a chain reaction of trade retaliation may soon cash in the big prize.

Via Benzinga · April 3, 2025

The chart of the Nikkei seems like a very well-formed and quite gargantuan top.

Via Talk Markets · April 1, 2025

The Bank of Japan estimates its neutral rate at between 1.0% and 2.5%.

Via Talk Markets · April 1, 2025

Whereas the US is down low single digits this year, most other countries have in that time risen well into the double digits.

Via Talk Markets · March 27, 2025

Known as the Oracle of Omaha, Warren Buffett has caught market attention with Berkshire Hathaway’s rising cash stockpile and increased positions in key stocks.

Via MarketBeat · March 25, 2025

Inflation figures for Tokyo and Singapore will be in focus over the coming week, alongside a decision on Chinese medium-term lending facility rates.

Via Talk Markets · March 21, 2025

Warren Buffett approves of Japan's top trading houses, with Berkshire Hathaway now holding a $23.5 billion stake. ETFs like EWJ and DXJ are gaining.

Via Benzinga · February 25, 2025

Japan's month-end data, especially Tokyo’s inflation, will be closely watched by Bank of Japan officials.

Via Talk Markets · February 21, 2025

Japan's consumer inflation rises to 3.2%, sparking expectations of BOJ hiking rates. ETFs EWJ, BBJP, and DXJ may see mixed outcomes as inflation and bond yields increase.

Via Benzinga · February 21, 2025

After two straight calendar years of red-hot performance, American shares are experiencing a run of muted results on the global stage.

Via Talk Markets · February 11, 2025

At the end of January, Japan will publish its month-end data, with the Bank of Japan paying particular attention to service prices.

Via Talk Markets · January 23, 2025

Central bank meetings in Japan, Indonesia, and the Philippines will take center stage over the week ahead in Asia, alongside an incoming data dump from China and CPI readings across the region.

Via Talk Markets · December 13, 2024

The BoJ trade is gaining momentum as investors bet on a weaker yen and higher Japanese equities. Trump's policies and BoJ decisions will impact its success.

Via Benzinga · December 12, 2024

We look at what’s in store in the region next week, including China’s Central Economic Work Conference, Australia’s cash target rate, India’s inflation data and the Japanese Tankan business survey.

Via Talk Markets · December 5, 2024

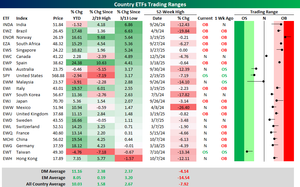

South Korea (EWY) is by far the worst performer today and it is also now the only one trading at a 52-week low too.

Via Talk Markets · December 3, 2024

PMIs and CPI data will be in focus across the region over the coming week, alongside a rate decision in India and Japan’s labor cash earnings.

Via Talk Markets · November 28, 2024

Looking at today’s long-term monthly chart, it appears that it is worthwhile to keep a close eye on the Nikkei index.

Via Talk Markets · November 21, 2024